The UK has one of the highest minimum wages in the world when adjusted for local purchasing power. But new analysis reveals this strong international standing does not necessarily translate into better living standards or wellbeing for low earners.

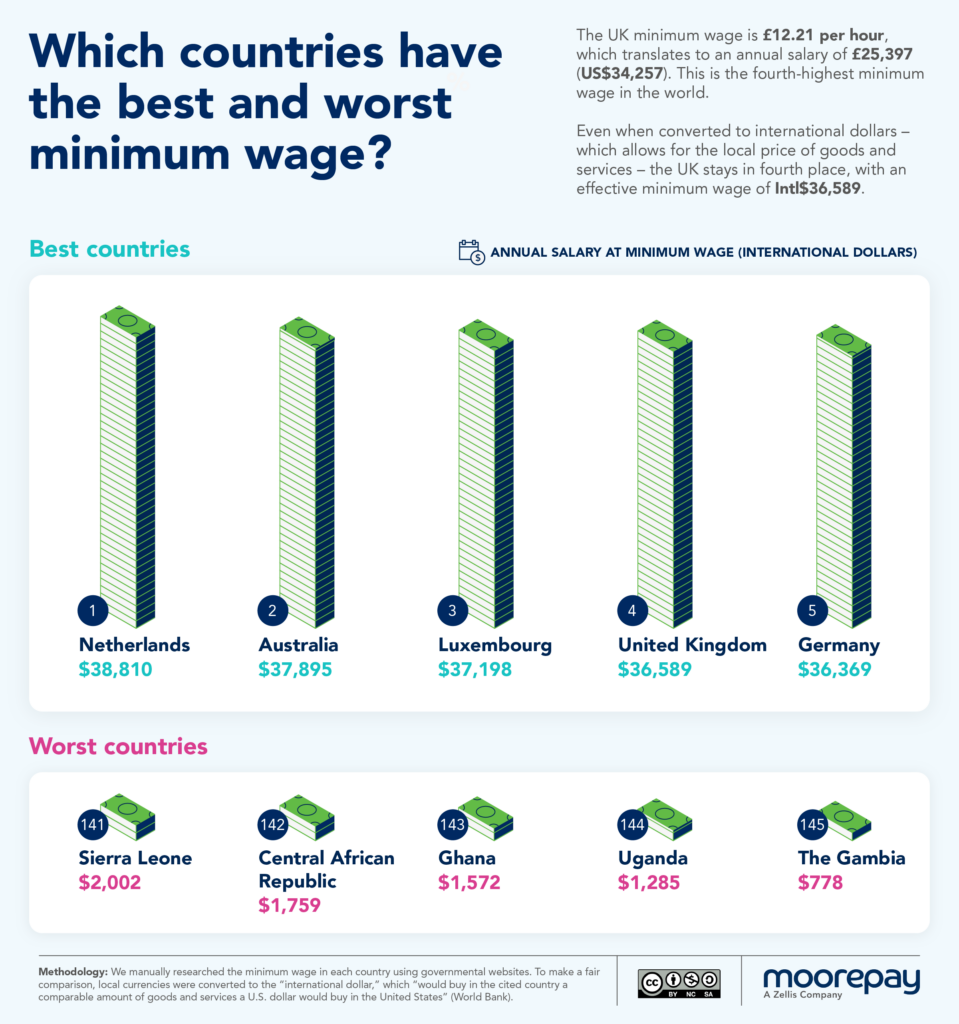

A global wage comparison index from Payroll firm Moorepay places the UK fourth among developed economies, with only Luxembourg, Australia and the Netherlands ranked higher. Its findings adjust for purchasing power parity (PPP), giving a clearer picture of how far a wage actually goes in real terms. Based on these figures, a full-time UK minimum wage salary is worth over International $36,000 per year.

But despite the comparative value, the reality for many workers is one of stress, insecurity and limited financial flexibility. Campaigners say the minimum wage still falls short of the cost of a decent life, especially as living costs continue to rise faster than wages.

A Strong Ranking But Limited Reach

The analysis shows that the UK’s minimum wage for over-21s rose to £12.21 per hour in April 2025, equivalent to an annual salary of £25,397. Adjusted for PPP, it becomes Intl $36,589. But it doesn’t close the gap between income and the real cost of living.

The Joseph Rowntree Foundation’s Minimum Income Standard, a measure of earnings and outgoings needs to live a comfortable life, suggests that a single working adult in the UK now needs £28,000 per year to maintain a socially acceptable standard of living. For families with children or people living in high-rent areas, the gap is naturally wider.

While many employers have voluntarily adopted the higher real Living Wage, set by the Living Wage Foundation, millions remain on statutory minimums.

Low Pay and Declining Wellbeing

The impact of low pay extends beyond financial strain. Multiple studies have shown a strong link between low income and poor mental health outcomes:

- Nearly half (46%) of full-time workers earning below the real Living Wage report negative impacts on mental health.

- Two-thirds (67%) experience increased anxiety, while 65% say low pay disrupts their sleep.

- More than half (53%) report relationship stress linked to financial instability.

The effects are even more pronounced in London, given the capital’s higher cost of living. A 2024 report found that 68% of low-paid Londoners said their quality of life was suffering, with 66% struggling to sleep and 65% experiencing mental health difficulties.

The Productivity Puzzle

One of the aims behind raising the national living wage was to boost productivity by motivating and retaining staff. While the proportion of low-paid workers has dropped significantly, research suggests productivity gains have not kept pace.

Instead, some analysts believe the increase in wages has been accompanied by greater work intensity. Younger workers report higher levels of burnout, while older staff cite increased physical strain.

This suggests that without wider wellbeing measures, wage rises alone may not deliver long-term benefits.

Beyond Legal Compliance

Employers have a key role to play in bridging the gap between income and wellbeing. In recent months, major companies such as Tesco have introduced extra support for lower-paid staff, including access to health services and wellbeing programmes.

Experts recommend several evidence-based approaches:

Consider voluntary accreditation: Becoming a Living Wage employer not only improves staff morale but can enhance recruitment and retention.

Invest in financial wellbeing: Offer tools such as budgeting workshops, emergency loans or signposting to impartial advice.

Prioritise job security: Insecure contracts amplify financial stress. Clear progression routes and stable hours build resilience.

Improve benefits access: Make sure that employee assistance programmes, mental health support and flexible leave policies are well-communicated and easy to use.